Term life insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

Term life insurance provides a straightforward and cost-effective way to ensure financial security for your loved ones in the event of an unexpected tragedy. Understanding the nuances of term life insurance can help you make informed decisions about your family’s future.

What is Term Life Insurance?

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg?w=700)

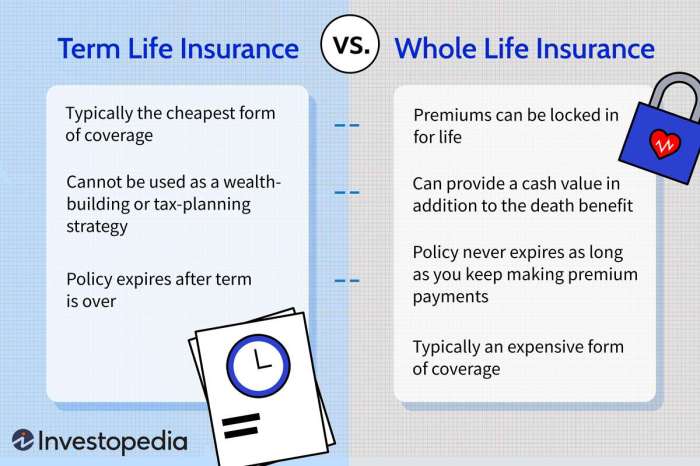

Term life insurance is a type of life insurance that provides coverage for a specified period, known as the term. Unlike permanent life insurance, which covers you for your entire life, term life insurance offers protection for a set number of years.

Key Differences from Other Types of Life Insurance

- Term life insurance only provides coverage for a specific term, typically ranging from 10 to 30 years, while permanent life insurance offers lifelong coverage.

- Term life insurance tends to be more affordable than permanent life insurance, making it a popular choice for individuals looking for temporary coverage.

- Unlike whole life insurance, term life insurance does not have a cash value component that can grow over time.

Typical Features and Benefits, Term life insurance

- Death Benefit: Term life insurance pays out a death benefit to your beneficiaries if you pass away during the term of the policy.

- Renewability: Some term life insurance policies offer the option to renew or convert the policy to a permanent life insurance policy at the end of the term.

- Convertible: Many term life insurance policies are convertible, allowing you to convert the policy to a permanent life insurance policy without the need for a medical exam.

- Flexibility: Term life insurance policies are flexible and can be tailored to meet your specific coverage needs and budget.

Types of Term Life Insurance Policies

Term life insurance policies come in various forms to suit different needs and preferences. Let’s explore the key types available:

1. Level Term Life Insurance

Level term life insurance provides a fixed death benefit payout and premiums throughout the policy term. This type of policy offers predictable costs and coverage, making it popular among individuals looking for stable protection.

2. Decreasing Term Life Insurance

Decreasing term life insurance offers a death benefit that decreases over time, typically aligning with a decreasing mortgage balance or other debts. Premiums remain consistent throughout the policy term, making it a cost-effective option for individuals with specific financial obligations.

3. Renewable Term Life Insurance

Renewable term life insurance allows policyholders to renew their coverage at the end of each term without undergoing a medical exam. While premiums may increase with each renewal, this type of policy offers flexibility and the ability to extend coverage as needed.

Each type of term life insurance policy has its unique characteristics and benefits, catering to different financial goals and circumstances. It’s essential to evaluate your needs and preferences carefully to choose the most suitable option for your situation.

Factors to Consider When Choosing Term Life Insurance

When selecting a term life insurance policy, there are several crucial factors to consider that can greatly impact your coverage and premiums. Factors such as age, health, coverage amount, and term length play a significant role in determining the best policy for your needs. Additionally, evaluating premiums, coverage options, and riders can help you tailor your policy to meet your specific requirements.

Age

Age is a key factor in determining the cost of a term life insurance policy. Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are typically considered lower risk by insurance companies. As you age, the cost of premiums may increase, so it’s essential to consider your age when choosing a term length and coverage amount.

Health

Your current health status also plays a crucial role in determining the cost and availability of term life insurance. Individuals with pre-existing medical conditions or poor health may face higher premiums or limitations on coverage options. It’s important to disclose accurate health information when applying for a policy to ensure you receive the appropriate coverage.

Coverage Amount

The coverage amount you select will directly impact the cost of your term life insurance policy. It’s essential to assess your financial obligations and future needs to determine the appropriate coverage amount. While higher coverage amounts offer more protection, they also come with higher premiums. Finding the right balance between coverage and affordability is key.

Term Length

The term length of your policy determines how long you will have coverage. Common term lengths include 10, 20, or 30 years. When choosing a term length, consider factors such as your age, financial responsibilities, and future plans. A longer term length may provide more extended coverage but could result in higher premiums.

Premiums, Coverage Options, and Riders

In addition to age, health, coverage amount, and term length, it’s crucial to evaluate the premiums, coverage options, and riders offered by different insurance companies. Comparing quotes from multiple providers can help you find a policy that aligns with your budget and specific needs. Additionally, exploring additional coverage options and riders, such as critical illness or disability riders, can enhance your policy to provide comprehensive protection.

Benefits of Term Life Insurance

Term life insurance offers several advantages compared to other forms of life insurance, making it a popular choice for many individuals. One of the key benefits of term life insurance is its affordability, as premiums are typically lower than permanent life insurance policies. This makes it an attractive option for individuals looking for coverage without breaking the bank.

Flexibility in Coverage

Term life insurance policies offer flexibility in coverage duration, allowing policyholders to choose a term that aligns with their needs. Whether it’s a 10, 20, or 30-year term, individuals can select a policy that provides coverage during the period they deem most crucial, such as while paying off a mortgage or until children are grown and financially independent.

High Coverage Amounts

Another benefit of term life insurance is the ability to secure high coverage amounts at a relatively low cost. This can be especially beneficial for individuals seeking substantial financial protection for their loved ones in the event of their untimely passing. With term life insurance, policyholders can ensure their beneficiaries are adequately cared for financially.

Suitable for Specific Life Stages

Term life insurance is often the most suitable option for individuals in specific life stages, such as young families or individuals with significant financial responsibilities. It provides a cost-effective way to protect loved ones during critical periods when financial support is essential. For example, term life insurance can be ideal for parents wanting to secure their children’s future or individuals with outstanding debts.

Financial Protection for Loved Ones

In the unfortunate event of the policyholder’s death, term life insurance can provide crucial financial protection for loved ones. The death benefit paid out to beneficiaries can help cover living expenses, outstanding debts, mortgage payments, education costs, and other financial obligations. This ensures that the policyholder’s family is not burdened with financial difficulties during a challenging time.

Overall, term life insurance offers affordability, flexibility, high coverage amounts, and crucial financial protection for loved ones, making it a valuable insurance option for many individuals.

In conclusion, term life insurance stands out as a reliable and affordable option to protect your family’s financial well-being. With its flexibility and clear benefits, term life insurance offers peace of mind and security for the future. Make the smart choice today and safeguard your loved ones with the right term life insurance policy.