Kicking off with Permanent life insurance, this opening paragraph is designed to captivate and engage the readers, setting the tone ahrefs author style that unfolds with each word.

Permanent life insurance provides lifelong coverage and a cash value component, offering financial security and asset protection. Let’s delve into the details of this long-term insurance option.

Overview of Permanent Life Insurance

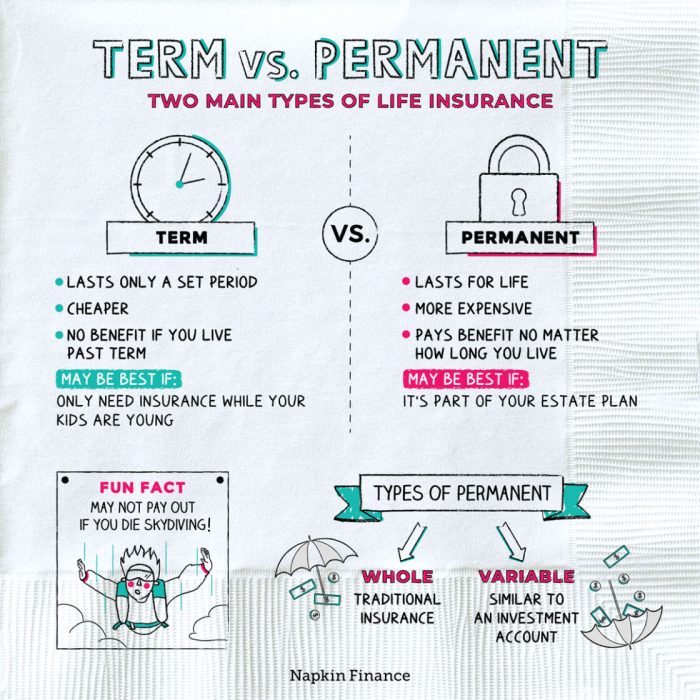

Permanent life insurance is a type of life insurance policy that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which only covers a specific period, permanent life insurance offers lifelong protection as long as the premiums are paid.

When looking for life insurance quotes , it’s important to compare different options to find the best coverage for your needs. Understanding the benefits of whole life insurance versus term life insurance can help you make an informed decision. Whole life insurance provides lifelong coverage with a cash value component, while term life insurance offers coverage for a specific period.

By exploring these options, you can choose the policy that suits your financial goals and provides peace of mind for the future.

One of the key features of permanent life insurance is the cash value component, which allows the policy to accumulate cash over time. This cash value can be accessed by the policyholder through loans or withdrawals, providing a source of funds for various financial needs.

When looking for life insurance quotes , it’s important to compare rates from different providers to find the best coverage for your needs. Understanding the benefits of whole life insurance can help secure your family’s financial future, while term life insurance offers affordable protection for a specific period. Each type of insurance has its own advantages, so it’s essential to research and choose the right policy that suits your circumstances.

Types of Permanent Life Insurance

- Whole Life Insurance: This type of permanent life insurance provides coverage for the entire lifetime of the insured and offers a guaranteed death benefit, fixed premiums, and a cash value component that grows over time.

- Universal Life Insurance: Universal life insurance offers flexibility in premium payments and death benefits, allowing policyholders to adjust their coverage and premiums based on their changing needs. It also provides a cash value component that earns interest based on market performance.

- Variable Life Insurance: Variable life insurance allows policyholders to invest their cash value in various investment options such as stocks and bonds. The cash value and death benefit of the policy can fluctuate based on the performance of the underlying investments.

Benefits of Permanent Life Insurance

Permanent life insurance offers a range of benefits that make it a valuable financial tool for individuals and families. Unlike term life insurance, which only provides coverage for a specific period, permanent life insurance offers lifelong protection. Here are some key advantages of having a permanent life insurance policy:

1. Lifetime Coverage

One of the primary benefits of permanent life insurance is that it provides coverage for the entire lifetime of the insured individual. This means that as long as the premiums are paid, the policy will remain in effect, offering peace of mind to policyholders and their loved ones.

2. Cash Value Accumulation

Another advantage of permanent life insurance is the ability to accumulate cash value over time. A portion of the premiums paid goes towards a cash value component, which grows on a tax-deferred basis. Policyholders can access this cash value through loans or withdrawals for various financial needs.

3. Estate Planning and Wealth Transfer

Permanent life insurance can also serve as a valuable tool for estate planning and wealth transfer. The death benefit paid out to beneficiaries is generally tax-free and can help cover estate taxes, debts, and other financial obligations. This can help preserve the wealth and assets of the insured for future generations.

4. Guaranteed Death Benefit

Unlike term life insurance, which only pays out a death benefit if the insured individual passes away during the term of the policy, permanent life insurance guarantees a death benefit regardless of when the insured dies. This ensures that loved ones are financially protected no matter when the loss occurs.

Overall, permanent life insurance offers a combination of lifelong coverage, cash value accumulation, estate planning benefits, and a guaranteed death benefit, making it a versatile and valuable financial tool for individuals and families.

Cash Value Component in Permanent Life Insurance

When it comes to permanent life insurance, one of the key features that sets it apart from term life insurance is the cash value component. This component allows policyholders to not only provide a death benefit for their beneficiaries but also accumulate savings over time.

What is Cash Value in Permanent Life Insurance?

The cash value in a permanent life insurance policy is essentially a savings account within the policy. A portion of the premium payments made by the policyholder goes towards this cash value, which grows over time on a tax-deferred basis. This means that the cash value can increase without being subject to income tax until it is withdrawn.

How Does the Cash Value Grow Over Time?

The cash value of a permanent life insurance policy grows through a combination of factors, including the interest credited to the account by the insurance company and any dividends paid on participating policies. Over the years, as the cash value grows, it can potentially accumulate a significant amount of savings that the policyholder can access.

Ways to Access the Cash Value

There are several ways in which policyholders can access the cash value in their permanent life insurance policy. Some common methods include:

- Policy Loans: Policyholders can borrow against the cash value of their policy, with the cash value serving as collateral. These loans typically have low interest rates and do not require a credit check.

- Partial Withdrawals: Policyholders can make partial withdrawals from the cash value of their policy, providing them with access to funds while still maintaining the death benefit.

- Surrendering the Policy: In some cases, policyholders may choose to surrender their policy in exchange for the cash value. However, it’s important to note that surrendering a policy may result in tax consequences and the loss of the death benefit.

Premiums and Payment Structure

When it comes to permanent life insurance, understanding how premiums are calculated and the different payment structures available is essential for policyholders to make informed decisions about their coverage.

Premium Calculation

- Premiums for permanent life insurance are typically calculated based on various factors such as the insured individual’s age, health, gender, and the coverage amount.

- Insurance companies also consider the type of permanent life insurance chosen, whether it’s whole life, universal life, or variable life, as each type has different premium structures.

- Additionally, the cash value component in permanent life insurance policies can also impact premium amounts.

Payment Structures, Permanent life insurance

- There are different payment structures available for permanent life insurance policies, including annual, semi-annual, quarterly, and monthly premium payment options.

- Policyholders can choose the payment frequency that aligns with their financial situation and preferences, but it’s essential to note that more frequent payments may incur additional fees.

- Some permanent life insurance policies also offer flexible payment structures, allowing policyholders to adjust premium amounts or payment frequency over time to accommodate changing financial needs.

Variation Based on Policy Type

- The type of permanent life insurance chosen can significantly impact premium payments. For example, whole life insurance typically has fixed premiums that remain constant throughout the policy’s lifetime.

- In contrast, universal life insurance policies offer more flexibility in premium payments, allowing policyholders to adjust the death benefit and premium amounts based on their financial goals and circumstances.

- Variable life insurance policies combine death benefit protection with investment options, which can lead to fluctuations in premium payments based on the performance of the underlying investments.

Riders and Additional Coverage Options

Adding riders and additional coverage options to a permanent life insurance policy can provide policyholders with extra benefits and customization. These options allow individuals to tailor their coverage to better suit their specific needs and circumstances.

Common Riders for Permanent Life Insurance

Common riders that can be added to a permanent life insurance policy include:

- Accelerated Death Benefit Rider: Allows the policyholder to receive a portion of the death benefit if diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives premium payments if the policyholder becomes disabled and is unable to work.

- Guaranteed Insurability Rider: Permits the policyholder to purchase additional coverage at specific intervals without the need for a medical exam.

Enhancing Protection with Additional Coverage Options

Additional coverage options can enhance the protection provided by permanent life insurance by:

- Increasing the death benefit to provide more financial security for beneficiaries.

- Offering flexibility in policy terms and benefits to adapt to changing life circumstances.

- Providing living benefits that can be accessed during the policyholder’s lifetime for emergencies or financial needs.

Beneficial Scenarios for Riders

Riders can be beneficial in various scenarios, such as:

- Providing financial support for the policyholder’s dependents in case of a critical illness or disability.

- Ensuring the policy remains in force even if the policyholder is unable to pay premiums due to unexpected circumstances.

- Allowing the policyholder to secure additional coverage as their financial responsibilities grow, without the need for a new policy or medical underwriting.

In conclusion, Permanent life insurance offers a secure way to protect your financial future and assets for a lifetime. With its cash value component and various benefits, it’s a valuable investment to consider for long-term financial planning.