Kicking off with Life insurance rates, this comprehensive guide covers all aspects of life insurance rates, from factors influencing them to strategies for lowering them. Dive in to get a clear understanding of how rates are determined and how you can save money on your premiums.

Factors influencing life insurance rates

When it comes to determining life insurance rates, several factors come into play. These factors can affect how much you pay for coverage and the type of policy you are eligible for. Let’s explore some of the key factors that influence life insurance rates.

Age impact on life insurance rates

Age is a significant factor that affects life insurance rates. Generally, younger individuals are offered lower premiums compared to older individuals. This is because younger people are considered less risky to insure as they are less likely to have serious health conditions or face mortality risks in the near future. As you age, the risk of developing health issues increases, leading to higher insurance rates.

Role of health conditions in determining rates

Your current health status plays a crucial role in determining your life insurance rates. Insurance companies assess your health condition to evaluate the level of risk you pose as an insured individual. Pre-existing medical conditions, such as heart disease, diabetes, or cancer, can result in higher premiums or even denial of coverage. Individuals with good health habits and no significant health issues typically qualify for lower insurance rates.

Impact of lifestyle choices on insurance premiums

Lifestyle choices, such as smoking, excessive drinking, or engaging in high-risk activities, can impact your life insurance rates. These behaviors are considered risky by insurance providers, as they increase the likelihood of premature death or health complications. Individuals with healthy lifestyle choices, like regular exercise and a balanced diet, are often rewarded with lower insurance premiums due to their lower risk profile.

Occupation’s influence on life insurance rates

Your occupation can also influence your life insurance rates. Certain professions are associated with higher risks due to the nature of the work involved. For example, individuals working in hazardous environments or high-stress jobs may face higher insurance premiums. On the other hand, individuals with low-risk occupations are likely to receive more affordable insurance rates. Insurance companies assess the occupational risk factors to determine the appropriate premiums for coverage.

Types of life insurance policies and their rates

Life insurance policies come in various forms, each with its own unique rates and features. Two common types of life insurance policies are term life insurance and whole life insurance, each offering different benefits and premiums.

Compare term life insurance rates with whole life insurance

Term life insurance typically offers coverage for a specific period, such as 10, 20, or 30 years, and tends to have lower premiums compared to whole life insurance. This is because term life insurance does not build cash value and is designed to provide coverage for a set term only.

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured individual and includes a cash value component that grows over time. As a result, whole life insurance premiums are typically higher than those of term life insurance.

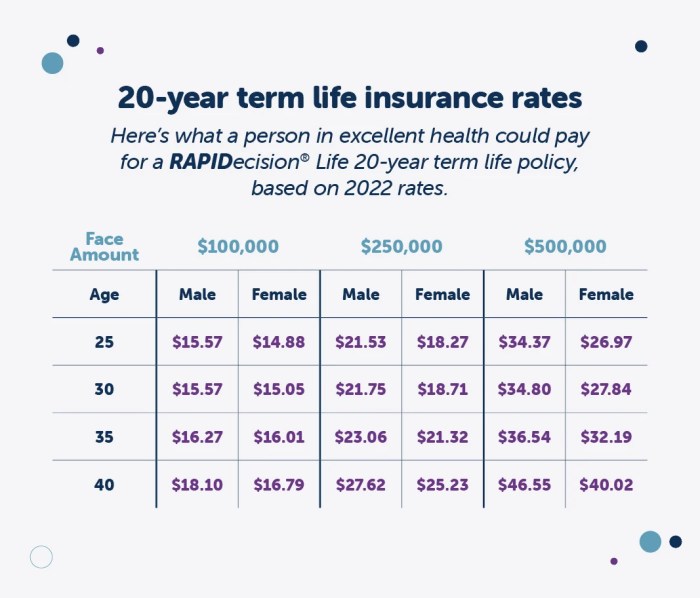

Elaborate on how coverage amounts affect insurance rates

The coverage amount, also known as the death benefit, plays a significant role in determining life insurance rates. Generally, the higher the coverage amount, the higher the premiums. Insurers calculate rates based on the risk of having to pay out the death benefit, so a larger coverage amount means a greater potential payout for the insurer.

Discuss how the length of the policy term influences premiums

The length of the policy term can also impact life insurance rates. Shorter policy terms, such as 10 years, typically have lower premiums compared to longer terms like 30 years. This is because the risk of the insured passing away during a shorter term is lower, resulting in lower premiums.

Provide examples of how riders can impact life insurance rates

Riders are additional features that can be added to a life insurance policy to customize coverage. Examples of riders include accelerated death benefit riders, waiver of premium riders, and accidental death benefit riders. Adding riders to a policy can increase premiums, as they provide additional coverage beyond the standard policy terms.

How insurers calculate life insurance rates

Life insurance rates are calculated by insurers based on a variety of factors to determine the level of risk associated with insuring an individual. This process involves a detailed analysis of the applicant’s personal information, medical history, lifestyle habits, and other relevant data to assess the likelihood of a claim being made. Let’s delve into the key components that insurers consider when calculating life insurance rates.

Significance of underwriting in determining rates

Underwriting plays a crucial role in determining life insurance rates as it involves evaluating the risk profile of the applicant. Insurers assess factors such as age, health status, occupation, and lifestyle habits to determine the likelihood of a claim being filed. Based on this risk assessment, insurers assign a premium rate that reflects the level of risk associated with insuring the individual.

Use of medical exams in setting insurance premiums

Medical exams are often required by insurers as part of the underwriting process to gather detailed information about the applicant’s health status. These exams help insurers assess the individual’s overall health, detect any underlying medical conditions, and evaluate the risk of potential health issues in the future. The results of the medical exams play a significant role in setting insurance premiums, as they provide valuable insights into the applicant’s health and help insurers make informed decisions about the level of risk involved.

Role of actuarial science in calculating life insurance rates

Actuarial science plays a fundamental role in determining life insurance rates by using statistical models and data analysis to estimate future claims and expenses. Actuaries analyze various factors, such as mortality rates, morbidity rates, and investment returns, to calculate the cost of providing insurance coverage. By utilizing actuarial science, insurers can accurately price their insurance products based on the expected costs associated with insuring individuals.

Impact of personal habits and hobbies on insurance costs

Personal habits and hobbies can have a significant impact on insurance costs, as insurers consider lifestyle factors that may affect an individual’s health and longevity. Activities such as smoking, excessive drinking, or engaging in high-risk sports can increase the risk of premature death or disability, leading to higher insurance premiums. Insurers take into account these factors when calculating life insurance rates to reflect the potential risks associated with certain habits and hobbies.

Strategies to lower life insurance rates

Life insurance rates can sometimes be high, but there are strategies you can implement to lower them. By taking certain actions, you can potentially reduce your premiums and save money in the long run.

Improving health to reduce insurance premiums

Taking steps to improve your health can have a positive impact on your life insurance rates. Insurers often consider factors such as weight, blood pressure, cholesterol levels, and overall health when determining premiums. By maintaining a healthy lifestyle, exercising regularly, and eating a balanced diet, you may be able to lower your rates.

Purchasing life insurance at a younger age

One of the most effective ways to lower life insurance rates is to purchase a policy at a younger age. Younger individuals are generally considered lower risk by insurers, which can result in lower premiums. By securing a policy early on, you can lock in lower rates for the duration of your coverage.

Comparing quotes from different insurers

Another strategy to lower life insurance rates is to compare quotes from different insurers. Shopping around and obtaining multiple quotes can help you find the most competitive rates available. By exploring your options and choosing the best offer, you can potentially save money on your life insurance premiums.

Bundling insurance policies for cost savings

Bundling insurance policies, such as life insurance with auto or home insurance, can also lead to cost savings. Many insurers offer discounts for bundling multiple policies together, making it a convenient and economical option for policyholders. By consolidating your insurance needs with one provider, you may be able to reduce your overall insurance costs.

In conclusion, understanding life insurance rates is crucial for making informed decisions about your coverage. By knowing the factors that impact rates and the strategies to lower them, you can secure the right policy at the best price. Take control of your financial future and protect your loved ones with the right life insurance plan.

When looking for life insurance quotes , it’s essential to compare different options to find the best coverage that suits your needs. Understanding the various factors that affect your premium can help you make an informed decision.

Having adequate life insurance coverage is crucial to ensure financial protection for your loved ones in case of unexpected events. It’s important to review your policy regularly to make sure it aligns with your current circumstances.

Consider opting for whole life insurance if you’re looking for a policy that provides coverage for your entire life. This type of insurance can also build cash value over time, offering additional benefits.