Life insurance calculator sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. With the ability to demystify complex insurance calculations, this tool becomes essential for anyone seeking clarity on their coverage needs.

As we delve deeper into the world of life insurance calculators, we uncover the intricate web of factors that influence your premiums and coverage. Let’s explore how this tool can empower you to make informed decisions about your financial future.

Introduction to Life Insurance Calculator

Life insurance calculators are valuable tools that help individuals determine the appropriate amount of life insurance coverage they may need. By inputting specific information about their financial situation, lifestyle, and future needs, users can receive an estimate of the ideal coverage amount to protect their loved ones in the event of their passing.

How a Life Insurance Calculator Works

Life insurance calculators typically require users to input information such as their age, gender, income, existing debts, monthly expenses, and future financial goals. Using this data, the calculator applies algorithms and formulas to calculate the recommended amount of life insurance coverage needed based on the user’s individual circumstances.

- Age: Younger individuals may require less coverage compared to older individuals.

- Income: Higher income earners may need more coverage to replace their income for their dependents.

- Debts: Outstanding debts such as mortgages or loans should be factored into the coverage amount.

- Expenses: Monthly expenses for necessities like housing, education, and healthcare should be considered.

- Financial Goals: Future goals such as college tuition for children or retirement savings impact the recommended coverage amount.

Benefits of Using a Life Insurance Calculator

Using a life insurance calculator offers several advantages that can help individuals make informed decisions about their life insurance coverage.

Accuracy of Calculations

- Calculations done manually may be prone to human error, resulting in inaccurate figures.

- A life insurance calculator uses precise algorithms to provide accurate estimates based on the information entered.

- By using a calculator, individuals can ensure that the coverage amount and premiums are calculated correctly.

Informed Decision-Making, Life insurance calculator

- With a life insurance calculator, individuals can quickly compare different coverage options and their associated costs.

- Users can input various scenarios to see how changes in coverage amount or policy type affect the premiums.

- This enables individuals to make informed decisions about the most suitable life insurance policy for their needs and budget.

Understanding Factors Considered in Calculations

When it comes to calculating life insurance premiums, several key factors are taken into consideration to determine the cost of coverage. These factors play a crucial role in assessing the level of risk associated with insuring an individual and help insurance companies set appropriate premium rates.

Age:

Age is a significant factor in determining life insurance premiums. Generally, younger individuals are considered lower risk as they are expected to live longer. As a result, younger policyholders typically pay lower premiums compared to older individuals. The logic behind this is simple – the older you are, the higher the likelihood of developing health issues or facing mortality.

Gender:

Gender also plays a role in life insurance calculations. Statistically, women tend to live longer than men, which is why women usually pay lower premiums compared to men of the same age and health status. This is based on actuarial data that shows differences in life expectancy between genders.

Health:

Your current health status and medical history are crucial factors in determining life insurance premiums. Insurance companies assess your overall health, including pre-existing conditions, lifestyle choices, and family medical history. Individuals with health issues or risky habits such as smoking may face higher premiums due to the increased likelihood of premature death.

Lifestyle:

Your lifestyle choices can impact your life insurance rates. Factors such as occupation, hobbies, travel habits, and participation in high-risk activities are considered by insurers. Engaging in activities that pose a higher risk of injury or death may lead to higher premiums to offset the increased risk to the insurance company.

Coverage Amount:

The amount of coverage you choose also influences your life insurance premiums. The higher the coverage amount, the higher the premiums you can expect to pay. This is because a larger coverage amount means the insurance company will have to pay out a larger sum in the event of your death, increasing their risk.

Overall, these factors interact to determine the cost of life insurance for an individual. By understanding how age, gender, health, lifestyle, and coverage amount impact premiums, you can make informed decisions when selecting a life insurance policy that best fits your needs and budget.

Using a Life Insurance Calculator Effectively

When it comes to using a life insurance calculator, it is essential to follow certain steps to ensure accurate results that can help you make informed decisions about your coverage needs.

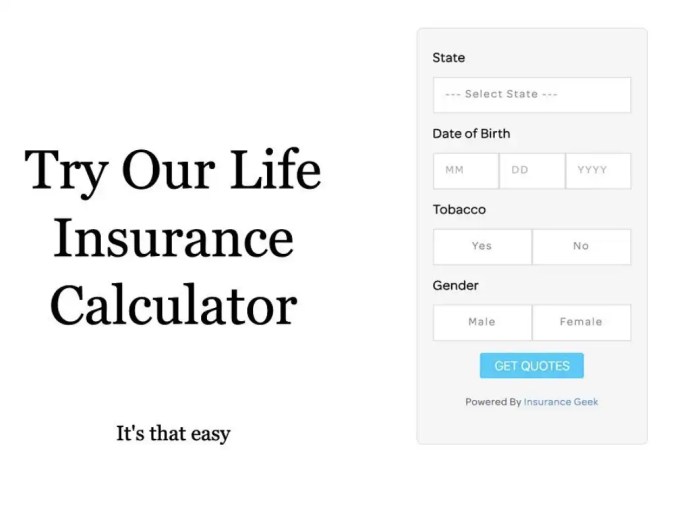

Step-by-Step Guide on How to Use a Life Insurance Calculator

- Start by entering basic information such as your age, gender, and smoking habits.

- Provide details about your annual income and expenses to determine the coverage amount you may need.

- Include any existing life insurance policies or savings that you want to consider in the calculation.

- Adjust the coverage term and type of policy to see how it affects the premiums and benefits.

Importance of Accurate Input

Accuracy is crucial when using a life insurance calculator as it directly impacts the results and recommendations provided. Make sure to input correct information to get a realistic estimate of your insurance needs.

Tips on Interpreting Calculator Results

- Review the coverage amount suggested by the calculator and compare it to your current financial obligations and future goals.

- Consider different scenarios by adjusting the inputs to see how changes in factors like coverage term or policy type affect the results.

- Consult with a financial advisor or insurance agent to get a better understanding of the results and to tailor the coverage to your specific needs.

In conclusion, life insurance calculators serve as invaluable resources in navigating the realm of insurance. By understanding the key factors at play and interpreting the results effectively, individuals can secure the right coverage for their needs. Take charge of your financial well-being with the insights provided by a life insurance calculator.

When it comes to protecting your family’s financial future, life insurance for families is a crucial investment. By choosing the best life insurance plans tailored to your needs, you can ensure that your loved ones are financially secure. Don’t overlook the importance of finding affordable life insurance that fits your budget while providing adequate coverage.

When it comes to protecting your family’s future, life insurance for families is essential. It provides financial security and peace of mind in case of unexpected events. Finding the best life insurance plans can be overwhelming, but with the right guidance, you can choose a policy that suits your needs. Don’t overlook the importance of affordable life insurance options that offer sufficient coverage without breaking the bank.