Compare life insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a brimming originality from the outset. Dive into the world of life insurance and unravel the complexities of different policy types, key factors to consider, coverage options, application processes, cost analysis, and benefits and payouts.

Types of Life Insurance: Compare Life Insurance

Life insurance comes in various forms to cater to different needs and preferences. The most common types include term life insurance, whole life insurance, and universal life insurance.

Term Life Insurance vs Whole Life Insurance

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit to beneficiaries if the policyholder passes away during the term. On the other hand, whole life insurance is permanent coverage that lasts a lifetime. It includes a cash value component that grows over time and can be withdrawn or borrowed against.

Universal Life Insurance

Universal life insurance is a flexible policy that combines a death benefit with a savings component. Policyholders can adjust their premiums and death benefits throughout the policy’s duration. The cash value in universal life insurance earns interest based on current market rates, providing potential growth over time.

Factors to Consider

When choosing a life insurance policy, there are several key factors to consider to ensure you get the right coverage for your needs. Factors such as premiums, age, and health conditions play a significant role in determining the type of policy that is best suited for you.

Premiums for Different Age Groups

As you consider life insurance options, it’s important to understand how premiums can vary based on your age. Generally, the younger you are when you purchase a policy, the lower your premiums are likely to be. This is because younger individuals are typically seen as lower risk by insurance companies. As you age, premiums tend to increase as the risk of health issues and mortality also increases.

Impact of Health Conditions on Life Insurance Rates

Your current health condition can have a significant impact on the rates you are offered for life insurance. Insurance companies will assess your health through a medical exam or review of medical records to determine the level of risk you pose. Factors such as pre-existing conditions, family medical history, and lifestyle choices can all influence the rates you are quoted. Individuals with serious health issues may face higher premiums or even be denied coverage altogether.

Coverage Options

When it comes to life insurance, there are various coverage options to choose from based on individual needs and financial goals. Understanding the differences between term life and permanent life policies, as well as the add-on coverage options available, can help you make an informed decision.

Term Life Policy vs. Permanent Life Policy

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term. On the other hand, permanent life insurance, such as whole life or universal life, provides coverage for the entire lifetime of the insured and includes a cash value component that grows over time.

- Term Life Policy:

- Lower premiums compared to permanent life insurance.

- Provides coverage for a specific term.

- Does not include a cash value component.

- Permanent Life Policy:

- Offers coverage for the entire lifetime of the insured.

- Includes a cash value component that grows over time.

- Premiums are typically higher than term life insurance.

Add-On Coverage Options

In addition to the basic coverage provided by life insurance policies, there are add-on options that can enhance your protection and customization. Some common add-on coverage options include:

- Accidental Death Benefit: Provides an additional payout if the insured’s death is caused by an accident.

- Disability Income Rider: Offers a monthly income benefit if the insured becomes disabled and unable to work.

- Long-Term Care Rider: Allows access to a portion of the death benefit to cover long-term care expenses.

- Critical Illness Rider: Provides a lump sum payment if the insured is diagnosed with a covered critical illness.

Application Process

When applying for life insurance, the process typically involves several steps to assess your eligibility and determine the coverage that best suits your needs.

Importance of Medical Exams

Medical exams play a crucial role in the life insurance application process as they help insurance companies evaluate your health status and assess the level of risk involved in insuring you. These exams may include basic tests like blood pressure, cholesterol levels, and overall health assessment. The results of these exams can influence the premiums you pay and the coverage you qualify for.

Underwriting in Life Insurance, Compare life insurance

Underwriting in life insurance refers to the process where insurers assess an applicant’s risk profile based on various factors like age, health condition, lifestyle, occupation, and medical history. Insurers use this information to determine the premium rates and coverage options available to the applicant. The underwriting process helps insurers manage risks effectively and ensure that policyholders receive the appropriate coverage for their needs.

Cost Analysis

When considering life insurance, one crucial aspect to evaluate is the cost associated with different types of coverage. Understanding the cost differences between various types of life insurance can help individuals make informed decisions based on their financial goals and needs.

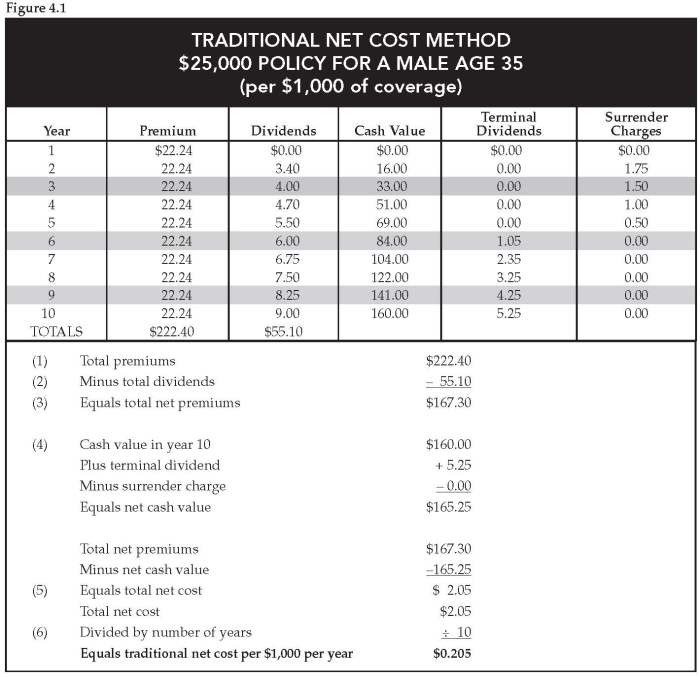

Term Life Insurance vs. Whole Life Insurance

Term life insurance is generally more cost-effective compared to whole life insurance. This is because term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, without any cash value component. As a result, the premiums for term life insurance are lower, making it a more affordable option for many individuals.

On the other hand, whole life insurance offers lifelong coverage along with a cash value component that grows over time. While whole life insurance provides added benefits such as the ability to accumulate cash value and potential dividends, it comes at a higher cost compared to term life insurance.

Factors such as age, health status, coverage amount, and policy duration can influence the cost differences between term and whole life insurance. It is essential to consider your financial situation and long-term goals when deciding between these two options.

Impact of Riders and Additional Coverage Options

Riders and additional coverage options can enhance the overall coverage of a life insurance policy but may also impact the cost. Riders are add-ons to a basic life insurance policy that provide extra benefits or coverage for specific situations, such as critical illness, disability, or accidental death.

While adding riders and additional coverage options can increase the cost of a life insurance policy, they can provide valuable protection and financial support in times of need. It is important to carefully evaluate the benefits of riders and additional coverage options against the associated costs to determine the most cost-effective solution for your individual needs.

Benefits and Payouts

Life insurance policies offer a sense of financial security to beneficiaries in the unfortunate event of the policyholder’s death. The benefits provided can help cover funeral expenses, outstanding debts, mortgage payments, and even provide a source of income for the family left behind.

Payout Structures of Term Life Insurance and Whole Life Insurance

- Term Life Insurance: This type of policy provides coverage for a specific period, usually ranging from 10 to 30 years. If the policyholder passes away during the term, the beneficiaries receive a lump sum payout.

- Whole Life Insurance: Whole life insurance offers coverage for the entire lifetime of the policyholder. In addition to the death benefit, this type of policy also accumulates cash value over time, which can be borrowed against or withdrawn by the policyholder.

How Beneficiaries can Claim Life Insurance Benefits

- Notify the Insurance Company: The beneficiaries need to inform the insurance company about the policyholder’s death as soon as possible.

- Submit Required Documents: The insurance company will typically require a death certificate and a claim form to process the benefit payout.

- Wait for Approval: Once all necessary documents are submitted, the insurance company will review the claim and, if approved, release the benefit amount to the beneficiaries.

Explore the nuances of life insurance policies and make informed decisions to secure your future or your loved ones’. With a clear understanding of the intricacies involved, you can navigate the realm of life insurance with confidence and clarity.