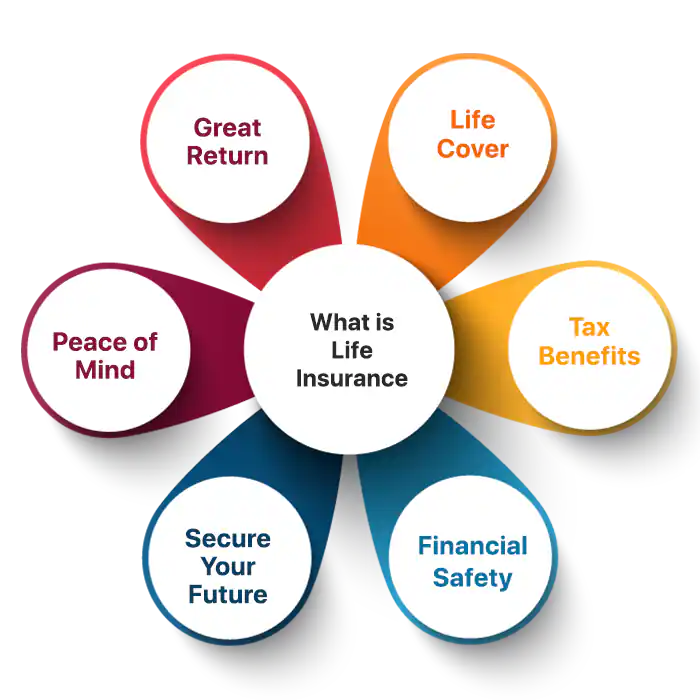

Starting off with Best life insurance plans, this guide aims to provide you with all the essential information you need to make an informed decision about life insurance. From understanding the different types of plans to selecting the best one for your needs, we’ve got you covered.

Types of Life Insurance Plans: Best Life Insurance Plans

Life insurance plans come in various forms to cater to different needs and preferences. Two common types are term life insurance and whole life insurance.

Term Life Insurance vs. Whole Life Insurance

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away during the term.

- Whole Life Insurance: Offers coverage for the entire lifetime of the insured. It includes a cash value component that grows over time and can be borrowed against or withdrawn.

Universal Life Insurance Benefits

Universal life insurance combines a death benefit with a savings component. Some benefits include:

- Flexibility in premium payments

- Option to adjust the death benefit amount

- Potential to earn interest on the cash value

Variable Life Insurance Features

Variable life insurance allows policyholders to invest premiums in sub-accounts similar to mutual funds. Key features include:

-

- Potential for higher returns based on market performance

- Risk of loss due to market fluctuations

- Flexibility to allocate funds among different investment options

Factors to Consider When Choosing Life Insurance

When selecting a life insurance plan, there are several key factors that individuals should consider to ensure they choose the most suitable coverage for their needs.

Age and Health Impact on Premiums

Age and health are crucial factors that can significantly affect life insurance premiums. Younger and healthier individuals generally pay lower premiums due to the lower risk of premature death. It is essential to secure life insurance coverage at a younger age to lock in lower premiums and ensure financial protection for loved ones.

Importance of Coverage Amount and Duration

Determining the right coverage amount and duration is vital when choosing a life insurance plan. The coverage amount should be sufficient to replace lost income, pay off debts, and cover future expenses for dependents. The duration of the policy should align with financial obligations, such as mortgage payments or children’s college tuition.

Significance of Riders in Enhancing Coverage

Riders are additional benefits that can be added to a life insurance policy to enhance coverage and customize protection based on individual needs. Common riders include accelerated death benefit, waiver of premium, and accidental death benefit. Adding riders can provide extra security and flexibility in times of need.

Understanding Premiums and Payouts

Life insurance premiums are calculated based on various factors such as age, health, lifestyle, coverage amount, and type of policy. Younger individuals in good health typically pay lower premiums compared to older individuals or those with health issues. The insurer assesses the risk of insuring an individual and determines the premium accordingly.

Difference Between Term and Permanent Life Insurance Payouts

Term life insurance provides coverage for a specific period, and if the insured passes away during the term, the beneficiaries receive the death benefit. Permanent life insurance, on the other hand, covers the insured for their entire life and pays out a death benefit whenever the insured passes away. Permanent life insurance also includes a cash value component that can be utilized during the insured’s lifetime.

Impact of Beneficiaries on Life Insurance Payouts

Beneficiaries are individuals or entities chosen by the policyholder to receive the death benefit in the event of the insured’s passing. It is essential to keep beneficiaries updated to ensure that the payout goes to the intended recipients. Failure to designate a beneficiary may result in the payout going to the insured’s estate and potentially facing probate.

How Lifestyle Choices Affect Life Insurance Premiums

Lifestyle choices such as smoking, excessive drinking, engaging in high-risk activities, or having a poor health history can increase life insurance premiums. Insurers consider these factors as they impact an individual’s life expectancy and overall health. Maintaining a healthy lifestyle can help lower premiums and secure more affordable coverage.

Selecting the Best Life Insurance Plan

When it comes to selecting the best life insurance plan, it is essential to consider various factors to ensure that you are adequately protected and that your loved ones are taken care of in the event of your passing. Here is a step-by-step guide on how to choose the best life insurance plan.

Determine Your Needs, Best life insurance plans

-

-

- Assess your financial obligations and consider how much coverage you will need to protect your family’s financial future.

- Consider factors such as outstanding debts, mortgage payments, children’s education expenses, and future income replacement.

-

Research Different Types of Life Insurance

-

-

- Understand the differences between term life insurance, whole life insurance, and universal life insurance to determine which type best suits your needs.

- Consider factors such as affordability, coverage length, and cash value accumulation when choosing the right type of policy.

-

Compare Quotes from Multiple Insurers

-

-

- Get quotes from different insurance companies to compare premiums, coverage options, and policy features.

- Consider working with an insurance broker who can help you navigate the options and find the best policy for your needs.

-

Review and Update Your Policy Regularly

-

-

- Review your life insurance policy annually to ensure that it still meets your needs and financial goals.

- Consider updating your policy if there have been significant life events such as marriage, divorce, the birth of a child, or changes in your financial situation.

-

Switching Life Insurance Plans

-

-

- If you find a better life insurance policy that offers more coverage or better rates, you can switch plans by applying for a new policy and canceling your existing one.

- Be sure to carefully review the terms and conditions of the new policy and understand any penalties or fees associated with canceling your current plan.

-

In conclusion, choosing the right life insurance plan is a crucial decision that can have a lasting impact on your financial well-being and that of your loved ones. With the information provided in this guide, you are now equipped to navigate the world of life insurance with confidence and make a choice that will secure your future.