Compare life insurance rates to ensure you’re getting the best coverage at the right price. Understanding the various types of life insurance and factors that affect rates is crucial in making an informed decision.

Types of Life Insurance: Compare Life Insurance Rates

Life insurance comes in various types, each offering different features and benefits tailored to meet different needs and preferences. Let’s explore the main types of life insurance available in the market:

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term. On the other hand, whole life insurance covers the insured for their entire life and includes a cash value component that grows over time. While term life insurance is more affordable, whole life insurance offers lifelong protection and an investment component.

Universal Life Insurance, Compare life insurance rates

Universal life insurance is a flexible form of permanent life insurance that allows policyholders to adjust their premium payments and death benefits. It offers a cash value component that earns interest over time, providing a potential source of savings or investment. Policyholders can also use the cash value to pay premiums or take out loans against the policy.

Variable Life Insurance

Variable life insurance combines the protection of life insurance with an investment component. Policyholders can allocate their premiums into different investment accounts, such as stocks or bonds, which can grow over time. The cash value and death benefit of variable life insurance can fluctuate based on the performance of the underlying investments, offering the potential for higher returns but also higher risks.

Factors Affecting Rates

Life insurance rates are influenced by various factors that insurers take into consideration when determining premiums. Understanding these factors can help individuals make informed decisions when purchasing life insurance.

Age Impact on Life Insurance Rates

Age is a critical factor that affects life insurance rates. Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered lower risk since they are less likely to have serious health issues or pass away prematurely. As you age, the likelihood of developing health conditions increases, leading to higher premiums to offset the increased risk for the insurer.

Role of Health in Determining Life Insurance Premiums

Health plays a significant role in determining life insurance premiums. Insurers assess your overall health and medical history to evaluate the risk of insuring you. Individuals with pre-existing health conditions or unhealthy habits may face higher premiums due to the increased likelihood of filing a claim. Maintaining good health through regular check-ups, exercise, and a healthy lifestyle can help lower life insurance costs.

Impact of Lifestyle Choices on Life Insurance Costs

Lifestyle choices can also impact life insurance costs. Factors such as smoking, excessive alcohol consumption, and participation in high-risk activities like extreme sports can lead to higher premiums. Insurers view these behaviors as increasing the chances of premature death or health complications, resulting in a greater financial risk for the company. Making positive lifestyle changes can not only improve your overall health but also reduce the cost of life insurance coverage.

Comparing Rates from Different Providers

When considering life insurance, comparing rates from various providers is crucial to ensure you are getting the best coverage at the most competitive price. Here are some tips on how to effectively compare life insurance rates from different companies.

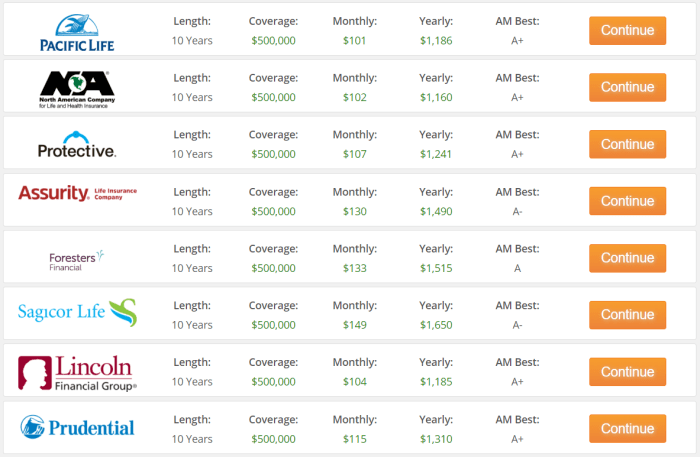

Sample Rates Comparison

- Company A: $30 per month for a $500,000 policy

- Company B: $35 per month for a $500,000 policy

- Company C: $25 per month for a $500,000 policy

Evaluating Coverage Options

Before making a decision solely based on rates, it is essential to evaluate the coverage options provided by each insurance company. Look into the types of policies offered, riders available, and any additional benefits that may be included in the coverage.

Financial Stability and Reputation Assessment

When comparing life insurance rates, it is equally important to assess the financial stability and reputation of the insurance provider. Look into the company’s credit ratings, customer reviews, and how long they have been in business. A financially stable and reputable insurance provider will give you peace of mind that your policy will be honored when needed most.

Understanding Rate Quotes

When it comes to life insurance, understanding rate quotes is crucial in making informed decisions. A life insurance rate quote typically includes important information that helps individuals assess the cost and coverage of a policy.

Information Included in a Life Insurance Rate Quote

- The premium amount: This is the cost of the insurance policy, usually paid monthly or annually.

- Coverage details: This Artikels the benefits and amount of coverage provided by the policy.

- Riders: Additional features that can be added to a policy to customize coverage, such as accidental death benefits or critical illness riders.

- Policy term: The length of time the policy will be in effect.

- Insured individual details: Information about the person being insured, such as age, gender, and health history, which can impact the rate.

Interpreting Premium Amount and Coverage Details

- Higher premiums often indicate more extensive coverage or higher benefit amounts.

- Understanding the coverage details is essential to ensure the policy meets your needs and provides adequate protection for your loved ones.

- Comparing premium amounts and coverage details from different quotes can help you choose the most suitable policy for your situation.

Impact of Riders on Life Insurance Rates

- Riders can increase the cost of a policy by adding extra benefits or coverage options.

- Popular riders include waiver of premium, which waives future premiums if the insured becomes disabled, or accelerated death benefit, which allows access to a portion of the death benefit if diagnosed with a terminal illness.

- Choosing riders wisely is important to tailor the policy to your specific needs while managing costs.

Common Discounts to Lower Life Insurance Premiums

- Multi-policy discount: Insurance companies may offer discounts if you bundle life insurance with other policies, such as auto or home insurance.

- Non-smoker discount: Individuals who do not smoke are often eligible for lower premiums compared to smokers.

- Healthy lifestyle discount: Maintaining a healthy lifestyle, such as regular exercise and a balanced diet, may qualify you for reduced rates.

In conclusion, comparing life insurance rates from different providers and understanding rate quotes is essential in choosing the most suitable policy for your needs. Make sure to weigh coverage options, financial stability, and reputation of insurance providers before making a decision.

When it comes to securing your family’s financial future, having the right life insurance agents can make all the difference. These professionals can help you navigate the complexities of choosing the best policy to suit your needs and budget.

One popular option to consider is term life insurance. This type of policy provides coverage for a specific period, offering peace of mind knowing your loved ones are protected in case of any unforeseen events.

On the other hand, permanent life insurance offers lifelong coverage along with a cash value component. It can serve as an investment tool in addition to providing financial protection for your family.