Best medical insurance companies are essential for securing your health and financial well-being. In this comprehensive guide, we dive deep into the top providers, coverage options, and factors to consider when choosing the right insurance for you.

From analyzing customer satisfaction to exploring additional benefits, this overview will equip you with the knowledge needed to make an informed decision about your medical insurance provider.

Researching the Best Medical Insurance Companies

When looking for the best medical insurance companies, it’s essential to consider various factors such as coverage options, reputation, and financial stability. By thoroughly researching and comparing different providers, you can make an informed decision that suits your healthcare needs.

Identifying the Top Medical Insurance Providers, Best medical insurance companies

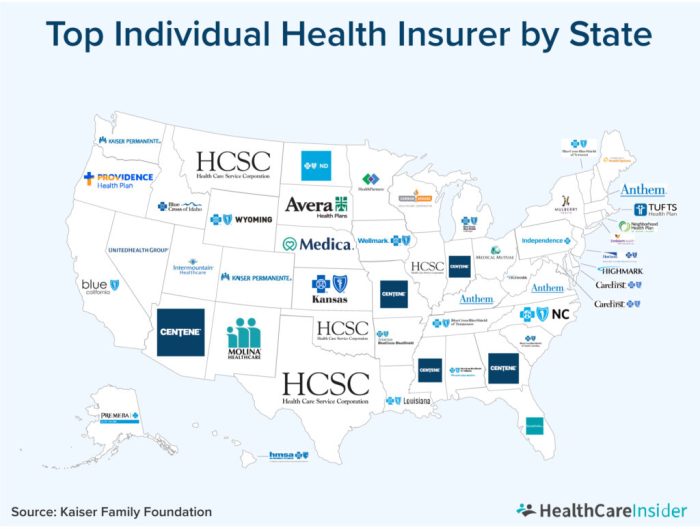

When researching the best medical insurance companies, some of the top providers in the market include Blue Cross Blue Shield, UnitedHealthcare, Aetna, Cigna, and Kaiser Permanente. These companies are known for their extensive network of healthcare providers and comprehensive coverage options.

Comparing Coverage Options

It’s crucial to compare the coverage options offered by different insurance companies to ensure that you get the best value for your money. Look for plans that include a wide range of services such as hospitalization, prescription drugs, preventive care, and specialist visits. Consider factors like deductibles, co-pays, and out-of-pocket maximums when comparing plans.

Assessing Reputation and Financial Stability

Research the reputation and financial stability of each insurance company before making a decision. Check customer reviews, ratings from independent agencies like A.M. Best, and the company’s history of paying claims. A financially stable company with a good reputation is more likely to provide reliable coverage and excellent customer service.

Factors to Consider When Choosing a Medical Insurance Company: Best Medical Insurance Companies

When selecting a medical insurance company, there are several crucial factors to take into account to ensure you make the best decision for your healthcare needs.

Network Coverage and Provider Options

Having access to a wide network of healthcare providers is essential when choosing a medical insurance company. Make sure the company’s network includes hospitals, clinics, doctors, and specialists that are conveniently located and meet your healthcare needs.

- Check if your current healthcare providers are part of the insurance company’s network.

- Consider the size and scope of the network to ensure you have options for quality care.

- Understand any restrictions or limitations on out-of-network care and how it may impact your coverage.

Cost Factors

The cost of your medical insurance goes beyond just the monthly premium. Understanding all the cost factors involved can help you choose a plan that fits your budget while providing adequate coverage.

- Compare premiums across different plans to find one that is affordable for your budget.

- Consider the deductible amount you will need to pay out of pocket before insurance coverage kicks in.

- Look at the copayments and coinsurance rates for doctor visits, prescriptions, and other medical services.

Policy on Pre-existing Conditions and Waiting Periods

If you have pre-existing medical conditions, it’s crucial to review the insurance company’s policy on covering these conditions. Additionally, understanding any waiting periods for coverage can help you plan for immediate healthcare needs.

- Find out if the insurance company covers pre-existing conditions and what limitations may apply.

- Review any waiting periods for specific treatments or services to avoid unexpected out-of-pocket expenses.

- Consider how the policy on pre-existing conditions may impact your overall healthcare costs and coverage.

Customer Satisfaction and Reviews

When it comes to choosing a medical insurance company, customer satisfaction and reviews play a crucial role in determining the quality of service provided. By exploring customer feedback and reviews on popular platforms, you can gain valuable insights into the overall experience of policyholders.

Level of Customer Service

- Customer service is a key aspect of any insurance company, as it reflects how well they handle inquiries, complaints, and issues raised by policyholders.

- Look for reviews that highlight prompt responses, helpful representatives, and efficient communication channels.

- Check if the insurance company offers multiple contact options, such as phone, email, or live chat, for easy accessibility.

Claims Processing Efficiency

- Efficient claims processing is essential for a smooth and hassle-free experience when making a claim.

- Research reviews that discuss the speed at which claims are processed and resolved by the insurance company.

- Look for feedback on the ease of submitting claims, documentation requirements, and transparency in the process.

Additional Benefits and Features

When choosing a medical insurance company, it is important to consider the additional benefits and features they offer beyond just basic coverage. These can enhance your overall healthcare experience and provide added value to your policy. Here are some key points to consider:

Wellness Programs and Telemedicine Services

Many medical insurance companies now offer wellness programs to help members maintain a healthy lifestyle. These programs may include access to fitness classes, nutrition counseling, and mental health resources. Additionally, telemedicine services allow members to consult with healthcare providers remotely, saving time and providing convenience.

Prescription Drug Coverage and Preventive Care

Coverage for prescription drugs is essential, as medication costs can add up quickly. Look for a medical insurance company that offers comprehensive prescription drug coverage with affordable copayments. Preventive care is also crucial for maintaining good health, so ensure that your policy includes coverage for annual check-ups, vaccinations, and screenings.

Unique Features and Benefits

Each insurance company may have unique features that set them apart from others. This could include personalized health coaching, discounts on gym memberships, or rewards programs for healthy behaviors. Consider what additional benefits are most important to you and choose a medical insurance company that aligns with your needs and lifestyle.

In conclusion, navigating the world of medical insurance can be overwhelming, but with the right information at your fingertips, you can confidently choose the best insurance company that meets your needs. Take charge of your health and financial security by selecting a provider that offers comprehensive coverage and exceptional customer service.

Looking for the best individual health insurance in 2024? Look no further! Our comprehensive guide to Best individual health insurance 2024 will help you find the perfect plan that suits your needs and budget.

When it comes to family medical insurance policies, you want to ensure that your loved ones are well-covered. Our detailed overview of Family medical insurance policies will guide you in choosing the right plan for your family’s healthcare needs.

Young adults often overlook the importance of health insurance. Our article on Health insurance for young adults highlights the importance of having a health insurance plan, especially for this demographic.