Whole vs term life insurance sets the stage for a detailed comparison between these two popular insurance options, shedding light on their differences and helping you make an informed decision.

As we delve into the nuances of whole and term life insurance, you’ll gain valuable insights into their coverage, costs, benefits, and flexibility, ultimately guiding you towards the most suitable choice for your needs.

Overview of Whole and Term Life Insurance

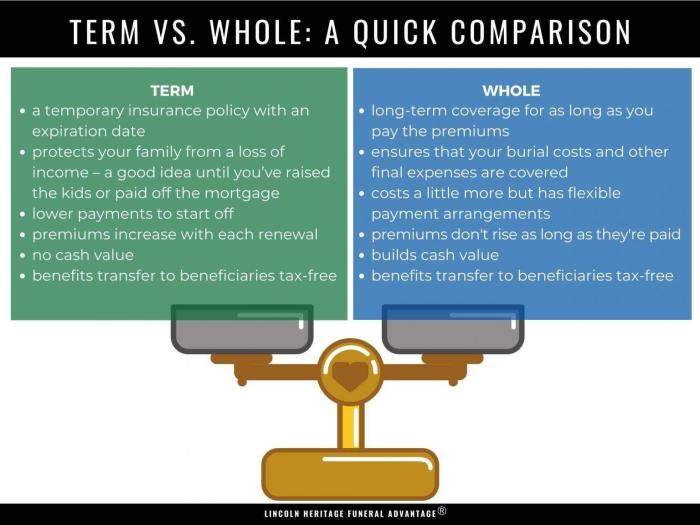

Life insurance is an essential financial product that provides protection and financial security for your loved ones in the event of your death. Two main types of life insurance are whole life insurance and term life insurance, each with distinct features and benefits.

When it comes to securing the future of our little ones, life insurance for children can provide peace of mind for parents. This type of insurance ensures financial protection and stability for the child in case of unforeseen circumstances. On the other hand, life insurance for young adults is essential for those starting their careers. It offers a safety net for individuals who may have financial dependents or outstanding debts.

Additionally, no medical exam life insurance is a convenient option for those who prefer a hassle-free application process.

Key Features of Whole Life Insurance

- Permanent Coverage: Whole life insurance provides coverage for your entire life, as long as premiums are paid.

- Cash Value Accumulation: A portion of your premiums goes towards a cash value component that grows over time.

- Guaranteed Death Benefit: Whole life insurance guarantees a death benefit payout to your beneficiaries.

- Level Premiums: Premiums remain constant throughout the life of the policy.

Main Characteristics of Term Life Insurance, Whole vs term life insurance

- Temporary Coverage: Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years.

- No Cash Value: Term life insurance does not accumulate cash value.

- Lower Premiums: Term life insurance typically has lower initial premiums compared to whole life insurance.

- Renewable and Convertible: Some term life policies are renewable and convertible to permanent coverage.

Coverage and Duration: Whole Vs Term Life Insurance

Whole life insurance and term life insurance offer different types of coverage and durations. Whole life insurance provides coverage for the entire lifetime of the insured, while term life insurance offers coverage for a specific period, usually ranging from 10 to 30 years.

Coverage Provided

- Whole Life Insurance: Whole life insurance provides coverage for the lifetime of the insured. It offers a death benefit to the beneficiaries upon the death of the insured, along with a cash value component that grows over time.

- Term Life Insurance: Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term of the policy.

Duration of Coverage

- Whole Life Insurance: Whole life insurance provides coverage for the entire lifetime of the insured. As long as the premiums are paid, the coverage remains in place.

- Term Life Insurance: Term life insurance offers coverage for a specific term, such as 10, 20, or 30 years. Once the term ends, the coverage expires, and the policyholder may need to renew at a higher premium rate.

Suitability Based on Coverage and Duration

- Whole Life Insurance: Whole life insurance is suitable for individuals looking for lifelong coverage and a cash value component that can be used for various purposes like retirement planning or as an inheritance for beneficiaries.

- Term Life Insurance: Term life insurance is suitable for individuals who need coverage for a specific period, such as until their children are financially independent or until a mortgage is paid off. It is also more affordable than whole life insurance for the same coverage amount.

Cost and Premiums

When it comes to whole life and term life insurance, one of the key considerations for individuals is the cost and premiums associated with each type of policy. Understanding the differences in cost structure and premium payments can help individuals make an informed decision based on their financial goals and needs.

Cost Differences

- Whole life insurance typically has higher premiums compared to term life insurance. This is because whole life insurance provides coverage for the insured’s entire lifetime, while term life insurance only covers a specific period.

- Term life insurance is generally more affordable because it offers temporary coverage for a set number of years, making it a popular choice for individuals looking for a cost-effective option.

- Whole life insurance premiums are structured to cover the cost of insurance as well as build cash value over time, which contributes to the higher cost compared to term life insurance.

Premium Structure

- Term life insurance premiums are typically fixed for the duration of the policy term. Once the term ends, the premiums may increase if the policyholder chooses to renew the coverage.

- Whole life insurance premiums are higher initially but remain level throughout the policyholder’s lifetime. A portion of the premium goes towards the cost of insurance, while the rest is allocated towards the cash value component.

- Whole life insurance policies also offer the option to pay premiums for a limited number of years while keeping the coverage in force for the insured’s entire life.

Factors Influencing Cost and Premiums

- Age and health are significant factors that impact the cost of life insurance premiums. Younger individuals and those in good health typically pay lower premiums compared to older individuals or those with pre-existing medical conditions.

- The coverage amount and policy term length also play a role in determining the cost of premiums. Higher coverage amounts and longer policy terms generally result in higher premium payments.

- The type of insurance, whether whole life or term life, will also influence the cost of premiums. Whole life insurance, with its cash value component, tends to have higher premiums compared to term life insurance.

Cash Value and Benefits

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg?w=700)

When it comes to whole life insurance, one of the key features is the concept of cash value. This refers to the savings component of the policy, where a portion of your premium payments goes into a cash account that grows over time. This cash value can be borrowed against or withdrawn, providing a source of funds that can be used for various purposes.

Cash Value in Whole Life Insurance

- Builds Over Time: The cash value in a whole life insurance policy grows steadily over the years, accumulating tax-deferred.

- Loan Option: Policyholders have the ability to take out a loan against the cash value, using it as collateral.

- Withdrawal: It is also possible to withdraw funds from the cash value, although this may affect the death benefit.

- Death Benefit: In the event of the policyholder’s death, the cash value is typically not paid out to beneficiaries, only the death benefit.

Benefits of Whole Life Insurance

- Lifetime Coverage: Whole life insurance provides coverage for the entire lifetime of the insured, as long as premiums are paid.

- Guaranteed Death Benefit: The policy guarantees a death benefit payout to beneficiaries upon the insured’s passing.

- Stable Premiums: Premiums for whole life insurance remain level throughout the life of the policy, providing predictability.

- Asset Protection: The cash value component offers a source of funds that can be accessed in times of need.

Term Life Insurance Comparison

In contrast to whole life insurance, term life insurance does not offer cash value accumulation. Term policies are designed to provide coverage for a specific term, such as 10, 20, or 30 years, without any savings component. While term life insurance is more affordable in terms of premiums, it does not offer the same benefits and cash value growth as whole life insurance.

Flexibility and Customization

When it comes to life insurance, flexibility and customization are crucial factors to consider. Let’s delve into how whole and term life insurance policies differ in terms of the options they offer to policyholders.

Flexibility in Whole Life Insurance

Whole life insurance policies provide a high level of flexibility and customization. Policyholders have the option to adjust their coverage amounts, premium payments, and even the frequency of payments. They can also add riders to their policy to tailor it to their specific needs, such as critical illness coverage or disability income protection. Additionally, whole life insurance policies build cash value over time, which can be accessed or used to pay premiums if needed.

Customization in Term Life Insurance

In contrast, term life insurance policies offer limited customization options. Policyholders typically select a coverage amount and term length, and once the policy is in place, there is little room for adjustments. While term life insurance is often more affordable than whole life insurance, it lacks the flexibility and long-term benefits that whole life insurance provides.

Meeting Financial Goals and Needs

The flexibility of whole life insurance makes it an attractive option for individuals looking to secure lifelong coverage and build cash value over time. This type of policy is well-suited for those who value stability and long-term financial planning. On the other hand, term life insurance can be a suitable choice for individuals with temporary financial needs or those looking for affordable coverage for a specific period.

In conclusion, understanding the level of flexibility and customization offered by whole and term life insurance policies is essential in selecting the right coverage to meet your financial goals and needs.

In conclusion, understanding the distinctions between whole and term life insurance is crucial in securing your financial future. By weighing the coverage, costs, and customization options of each type, you can confidently select the policy that aligns best with your long-term goals and priorities.

Life insurance for children is often overlooked, but it can provide valuable protection for the future. Investing in a policy for your child can help cover funeral expenses or medical bills in case of unexpected events. Additionally, it can secure their insurability for future coverage. To learn more about the benefits of life insurance for children , visit our website.

As young adults start their careers and families, life insurance becomes an essential financial tool. It offers protection for loved ones in the event of an untimely death. Choosing the right policy can provide peace of mind and financial security. Explore the options available for young adults life insurance on our website.

For those who want coverage without the hassle of a medical exam, no medical exam life insurance is the perfect solution. This type of policy offers quick approval and coverage without the need for extensive paperwork. Find out more about the benefits of no medical exam life insurance by visiting our website today.