Universal life insurance, a versatile financial tool, offers a unique blend of flexibility and long-term benefits. Let’s dive into the intricacies of this insurance option to uncover its advantages and potential pitfalls.

As we navigate through the details of universal life insurance, we’ll explore its various types, benefits for policyholders, and important considerations to keep in mind.

Definition of Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. Unlike term life insurance, which provides coverage for a specific period, and whole life insurance, which has fixed premiums and guaranteed cash value accumulation, universal life insurance allows policyholders to adjust their premiums and death benefits over time.

Key Features of Universal Life Insurance Policies

Universal life insurance policies typically consist of the following key features:

- Flexible Premiums: Policyholders can adjust the amount and frequency of premium payments within certain limits.

- Adjustable Death Benefit: Policyholders can increase or decrease the death benefit amount based on their changing needs.

- Cash Value Accumulation: A portion of the premium payments goes towards a cash value account that earns interest over time.

- Investment Options: Some universal life insurance policies offer investment options to potentially grow the cash value faster.

Comparison to Term Life Insurance and Whole Life Insurance

When compared to term life insurance, universal life insurance provides lifelong coverage and the potential for cash value accumulation. On the other hand, term life insurance offers coverage for a specific term at a lower cost.

In contrast to whole life insurance, universal life insurance offers more flexibility in premium payments and death benefits. While whole life insurance has fixed premiums and guaranteed cash value accumulation, universal life insurance allows for adjustments based on the policyholder’s changing needs.

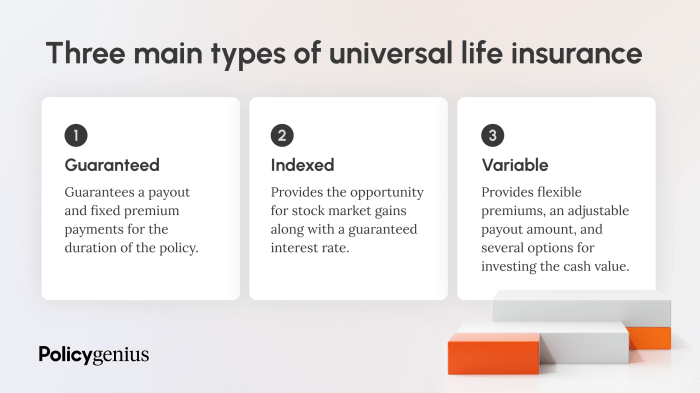

Types of Universal Life Insurance

Universal life insurance comes in various forms to cater to different needs and preferences. Let’s explore the different types along with their advantages and disadvantages.

Indexed Universal Life Insurance

Indexed universal life insurance offers the potential for cash value growth based on the performance of a specific market index, such as the S&P 500. This type of policy provides a cap on the returns, protecting against market downturns while still allowing for some growth. Indexed universal life insurance can be suitable for individuals seeking higher growth potential than traditional universal life insurance, with some downside protection.

Guaranteed Universal Life Insurance

Guaranteed universal life insurance provides coverage for the insured’s entire lifetime with fixed premiums. This type of policy offers a guaranteed death benefit and cash value accumulation, making it a reliable option for those looking for long-term coverage without the risk of market fluctuations. Guaranteed universal life insurance is suitable for individuals who prioritize stability and predictability in their life insurance coverage.

Variable Universal Life Insurance

Variable universal life insurance allows policyholders to invest their cash value in various sub-accounts, similar to mutual funds. The returns on these investments are not guaranteed and can fluctuate based on market performance. This type of policy offers the potential for high returns but also comes with higher risk due to market exposure. Variable universal life insurance is ideal for individuals comfortable with investment risk and seeking the opportunity for significant cash value growth.

Survivorship Universal Life Insurance

Survivorship universal life insurance covers two individuals under a single policy, typically spouses or business partners. The death benefit is paid out upon the passing of the second insured, making it a cost-effective option for estate planning and wealth transfer. Survivorship universal life insurance is suitable for couples or business partners looking to leave a financial legacy for their heirs or cover estate taxes.

Benefits of Universal Life Insurance

Universal life insurance offers a range of benefits for policyholders, making it a versatile financial tool for various needs. Here are some potential advantages of universal life insurance:

Estate Planning and Wealth Transfer

Universal life insurance can play a crucial role in estate planning by providing a tax-efficient way to transfer wealth to beneficiaries. Policyholders can use the death benefit to cover estate taxes, ensuring that their loved ones receive the intended inheritance without financial burden. Additionally, universal life insurance policies can be structured to create a legacy for future generations, preserving wealth and providing financial security for heirs.

Tax Advantages

One of the key benefits of universal life insurance is the tax advantages it offers. Cash value growth within the policy is tax-deferred, meaning that policyholders can accumulate funds without immediate tax implications. Additionally, the death benefit is generally income tax-free for beneficiaries, providing a valuable source of liquidity to cover expenses and financial obligations. Policyholders may also have the option to access cash value through loans or withdrawals on a tax-advantaged basis, further enhancing the flexibility and financial benefits of universal life insurance.

Risks and Considerations

When considering purchasing a universal life insurance policy, it is essential to understand the risks involved and factors that can affect the policy’s performance. Here are some key points to consider and tips on how to mitigate risks associated with universal life insurance.

Risks Involved with Universal Life Insurance Policies

- Interest rate risk: Universal life insurance policies are sensitive to changes in interest rates. If interest rates decrease, the policy’s cash value growth may slow down, affecting the policy’s performance.

- Cost of insurance risk: The cost of insurance charges within a universal life insurance policy can increase over time, impacting the policy’s affordability.

- Market risk: The cash value component of a universal life insurance policy is often invested in the market, exposing it to market fluctuations and potential losses.

Factors to Consider Before Purchasing a Universal Life Insurance Policy

- Your financial goals and risk tolerance: Evaluate whether a universal life insurance policy aligns with your long-term financial objectives and risk tolerance.

- Premium payment flexibility: Understand the impact of varying premium payments on the policy’s cash value and death benefit.

- Policy performance illustrations: Review the policy’s performance projections to ensure they meet your expectations and financial needs.

Tips on How to Mitigate Risks Associated with Universal Life Insurance

- Regular policy reviews: Periodically review your universal life insurance policy with your financial advisor to ensure it continues to meet your financial goals.

- Adjusting coverage: Consider adjusting your coverage or premium payments based on changes in your financial situation or life circumstances.

- Diversification: Diversify the investments within the policy’s cash value component to reduce the impact of market volatility.

In essence, universal life insurance stands out as a comprehensive solution for financial planning, offering a balance between security and growth potential. By understanding the nuances of this insurance product, individuals can make informed decisions to safeguard their future.

When it comes to planning for the future, a life insurance calculator can be a valuable tool to help determine the coverage you need. By inputting your financial information and goals, you can get an estimate of how much coverage is appropriate for your situation. Once you have a better idea of your needs, it’s important to connect with knowledgeable life insurance agents who can guide you through the process.

These professionals can help you explore different policy options and find the best fit for your needs and budget. With the right life insurance in place, you can have peace of mind knowing your loved ones are protected financially.

When planning for the future, it’s important to consider factors like finances and security. A life insurance calculator can help you determine the coverage you need to protect your loved ones. However, navigating the complex world of insurance can be overwhelming without the guidance of experienced life insurance agents. They can provide personalized advice to help you choose the right policy that fits your needs and budget.

With the right life insurance in place, you can have peace of mind knowing your family is financially secure.